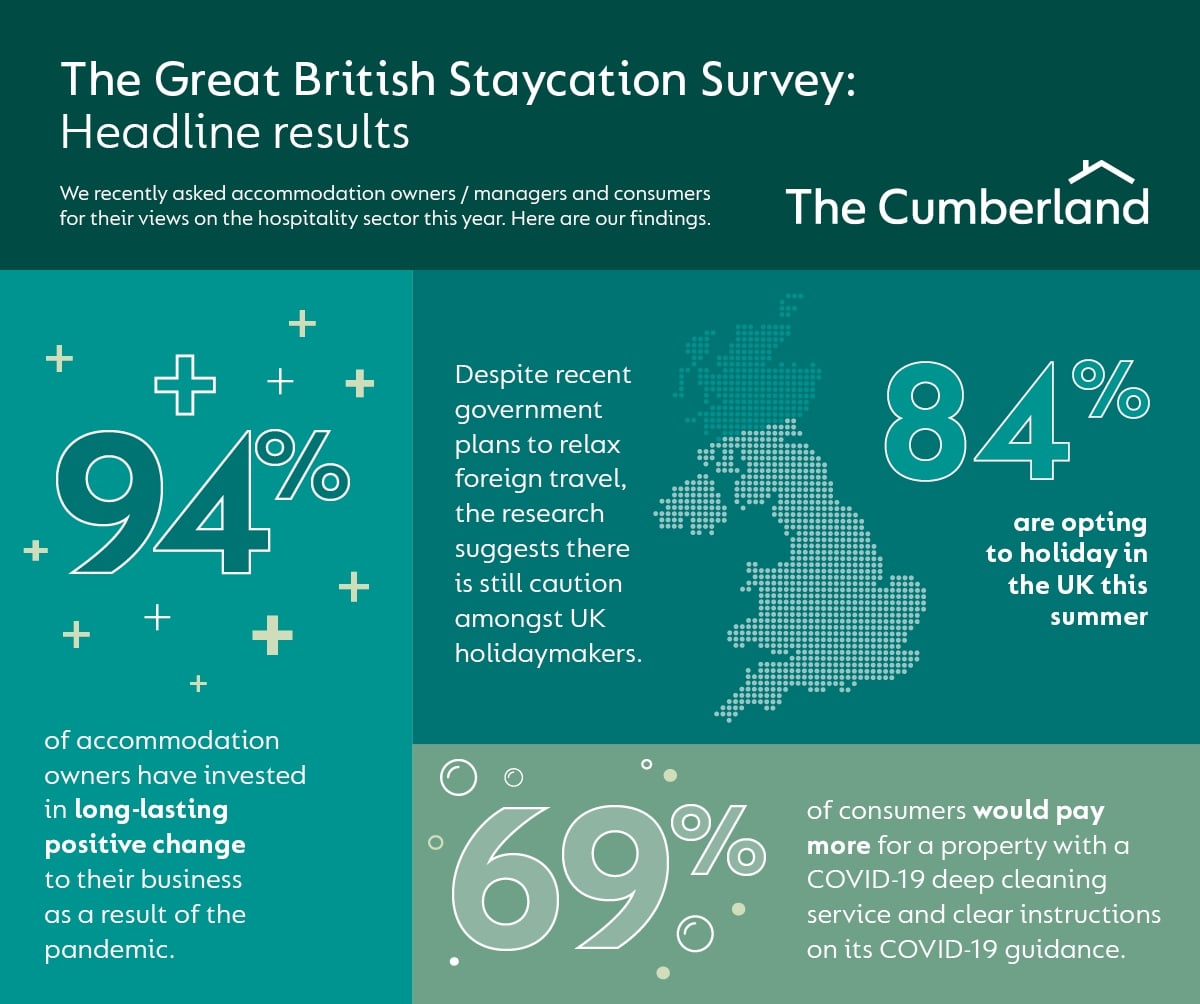

With research showing that 94% of accommodation owners have invested in long-lasting positive change to their business as a result of the pandemic, Scott McKerracher, Head of Commercial at building society, The Cumberland uncovers more details from the findings of this national survey.

“We were interested that our recent survey revealed that 86% of holiday accommodation owners say they have invested in their business during the pandemic, with 94% of them indicating they have made a long-lasting, positive change.

We have a long-established hospitality lending team here at The Cumberland, and so it was important to us to survey 1,021 UK adults and 233 UK accommodation owner/managers to find out their attitudes and identify any growing trends.

Staycations have increased in popularity, as 84% of consumers who responded said they were opting to holiday in the UK this summer. Of these, the survey also revealed that hotels (38%) and cottages (32%) are the most popular types of accommodation, followed by bed and breakfast accommodation (24%).

16% say they’d pay more for dog-friendly accommodation

However, COVID-19 compliance and cleanliness is still dominating consumers’ choice of accommodation providers, as 69% say they are willing to pay more for hotels, B&Bs and holiday lets offering these additional services: 38% said they would pay more for a property which has a COVID-19 deep cleaning service, while 31% would pay more for a property with clear instructions on its COVID-19 guidance.

Perhaps alluding to the increase in lockdown puppies, 16% of Brits say they would pay more if their accommodation was dog-friendly!

The findings from this national survey suggest that when it comes to destinations, Cornwall is the favourite UK destination (17%) with the Lake District proving as popular as Devon (14% each), followed closely by the Scotland (13%), Wales (11%) and East Anglia (9%). However, 32% of consumers indicated they are not planning a holiday this year.

Four-fifths of holiday accommodation owners questioned (80%) said that they had been spending money on being compliant with COVID-19 guidelines, while 71% have been improving their property or services.

This dual research amongst consumers and UK holiday accommodation owners provides really important insights into the opportunities and challenges currently faced by the British hospitality industry, as it navigates its way out of the pandemic and into the ‘new normal’.

With mortgage customers across the UK hospitality industry, including hotels, B&Bs and holiday let owners, we understand how optimism within the market can show a clear way forward for this sector.

75% considering using Government Recovery Loan Scheme

When it comes to business funding during the pandemic, 52% of those surveyed funded their investment in their business from savings/ equity contribution; 41% from a business loan; 26% from insurance; 21% from external equity; 17% from CBILS* or BBLS* loans and 15% from remortgage.

Additionally, 75% said they were definitely going to or are considering using the Government Recovery Loan Scheme, which could indicate that this hasn’t been a necessity for many, as it was only introduced in April.

We also asked them about investing in their businesses over the three years 2020-2022 inclusive and from the findings, the consistent turnover figure cited by owner managers as having invested or planning on investing in their properties is 11-20% of turnover. Overall, 94% of those questioned have made a long-lasting positive change to their business as a result of the pandemic. And of this, 55% of respondents said that renovations were the main long-lasting positive changes the pandemic has led them to make to their business. This is followed by process improvements (46%); introducing new services (45%) and new IT systems (34%).

Optimism and resilience

The research findings regarding the use of CBILS and BBLS is interesting and encouraging, as it demonstrates that the businesses had other means to invest for the future and the level of investment to which businesses are committing demonstrates optimism and resilience during a very challenging time and will hopefully be rewarded as consumer confidence and demand to holidaying in the UK continues to grow.

It is also interesting to note that the research uncovered changing booking patterns amongst UK consumers, with 36% saying they would book UK holidays between less than one month ahead and three months ahead of time, whilst only 6% said they would plan to book 10-12 months ahead. 26% said they would not plan to book a UK holiday whilst in the current COVID circumstance. 56% of respondents cited concerns about cancellations due to the impact of new strains of the virus as their biggest concern over the summer season, while 31% of accommodation owners said that they were concerned about customers ‘double-booking’ holidays and then cancelling with them at the last minute.

It is very clear from our consumer research that a UK holiday is by far and away the main choice for British consumers this summer and it seems that many UK accommodation owners have decided to invest in their businesses not only for the short term but also to make long lasting, positive change. This can only bode well for the sector going forward, as consumer confidence rises to match.”